Launching a subscription-based business means that you will be instituting recurring payment processing. This will ensure that customers’ funds are collected regularly and accurately, while also helping to contend with account changes and late payments.

But how can your subscription-based model address the ongoing thorn in your side known as chargebacks?

Chargebacks defined.

Consumers have the legal right to challenge a credit card charge if they are not happy with a product or service ,or if they believe that the charge was unauthorized. When they initiate an official dispute with their bank or credit card company, this is known as a chargeback.

Subscription businesses whose model is built on recurring billing can be particularly affected by chargebacks, which frequently occur if consumers forget about the arrangement, regret that they have made it, or fail to cancel it in accordance with the terms of the contract they signed.

Fighting a chargeback can be time-consuming for you, the merchant. Worse still, an above-average number of disputes can lead to added costs for recurring payment processing and, in extreme cases, even account closure.

That is why chargeback prevention is so important.

Make free trials free.

In most cases, it is not necessary to collect credit card details before initiating a promotional product trial. If you must gather this information for some reason, set your automated systems to send out a reminder a few days before the period in question ends that allows customers time to cancel.

This will reduce the number of chargebacks you receive from people who already planned to terminate but simply forgot to do so.

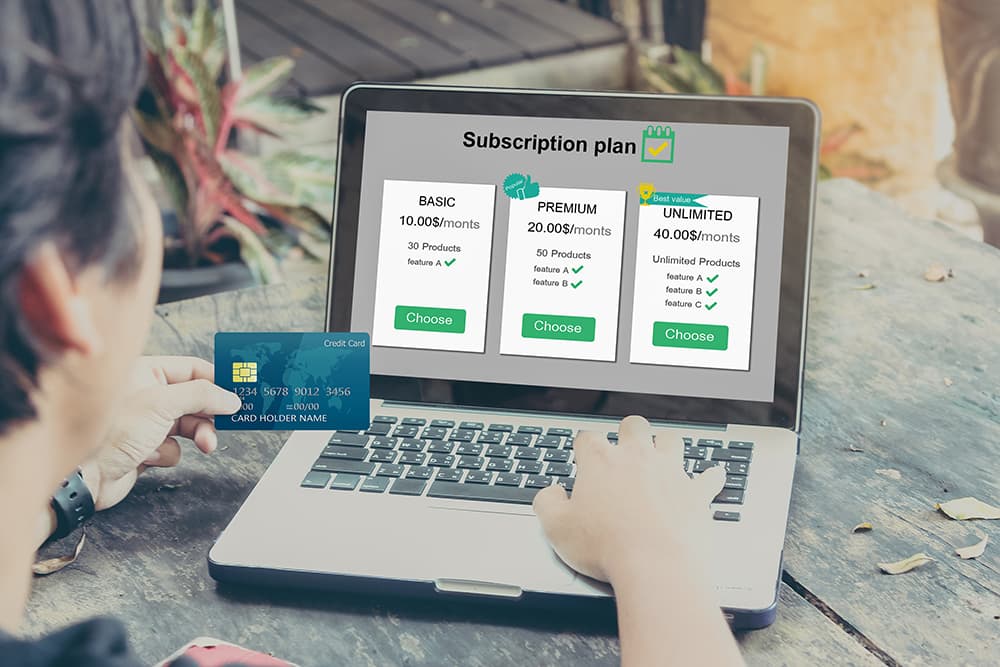

Offer tiered pricing.

For any number of reasons, people’s financial situations change, making them unable to continue with a subscription at its current level.

Furnishing lower-priced options, albeit with scaled-down product offerings, gives customers a way to stay connected in a way that they can afford.

Be clear about refunds and returns.

Many chargebacks stem from confusion about terminating services or sending items back. This can sometimes happen if your policies are not prominently displayed and easy to understand.

Therefore, place your written stipulations right on your checkout page where they are visible, and get advanced feedback from others to be sure that they make sense.

Make transparency your highest priority.

It never hurts to re-emphasize to customers that they are signing up for a subscription program that involves recurring billing. Repeatedly specify charge frequency, the dates when future transactions will occur, and the amount to be paid.

Prior to each fund withdrawal, send a reminder, and then confirm that money was withdrawn so that people will be primed to expect the costs on their statement.

Make cancellation easy.

If people cannot terminate your services without complications or the need to jump through a thousand hoops, they will be more likely to file a dispute. Make cancelling easier than it would be to file a chargeback, and you may see your dispute numbers fall.

Implement a robust chargeback solution.

Today’s recurring payment processing software providers offer highly effective fraud and chargeback prevention tools.

Once configured, they can send you a daily summary of all potential fraud and dispute activity, giving you the chance to address every incident right away. People respond positively when you react rapidly to address concerns and solve problems.

No matter how hard you work, you will always experience charge disputes in your subscription business.

However, optimizing transparency, providing varied pricing, facilitating easy cancellations, and investing in high-quality chargeback prevention software can make all the difference in minimizing them for your recurring billing-based company.